The Internal Revenue Service (IRS) has announced that taxpayers can begin filing their 2021 tax returns on Monday, January 24, 2022

The Jan. 24 tax-filing start date for 2022 is 19 days earlier than 2021’s start date of Feb. 12.

At the same time, the IRS warns that the upcoming filing season could be frustrating for taxpayers and tax preparers alike due to pandemic-related delays, a backlog of unprocessed returns from 2021, and years of budget cuts that have made the agency’s job more difficult.

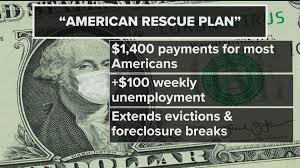

KEY TAKEAWAYS

- Taxpayers can begin filing 2021 tax returns Monday, Jan. 24, 2022, 21 days earlier than last year.

- The IRS has warned there could be delays in issuing refunds in 2022 due to issues related to the pandemic, budget cuts, and unprocessed returns from 2021.

- The tax agency cautions taxpayers to file as early as possible after Jan. 24 and to make sure they have their paperwork in order.

- The IRS suggests taxpayers look for help online and use phone lines only if necessary.

- The agency says if you file electronically, choose direct deposit, and, assuming there are no issues with your return, you should get your refund within 21 days.

To avoid processing delays and speed refunds, the IRS urges people to follow these steps.

- Gather your 2021 tax records including Social Security number, Individual Taxpayer Identification Number, Adoption Taxpayer Identification Number, and this year’s Identity Protection Personal Identification Number for calendar year 2022.

- Check IRS.gov for the latest tax information, including the latest on how to reconcile advance payments of the Child Tax Credit or claim a Recovery Rebate Credit for missing stimulus payments.

- Make sure you report correct amounts for any Economic Impact Payments or advance Child Tax Credits received in 2021.

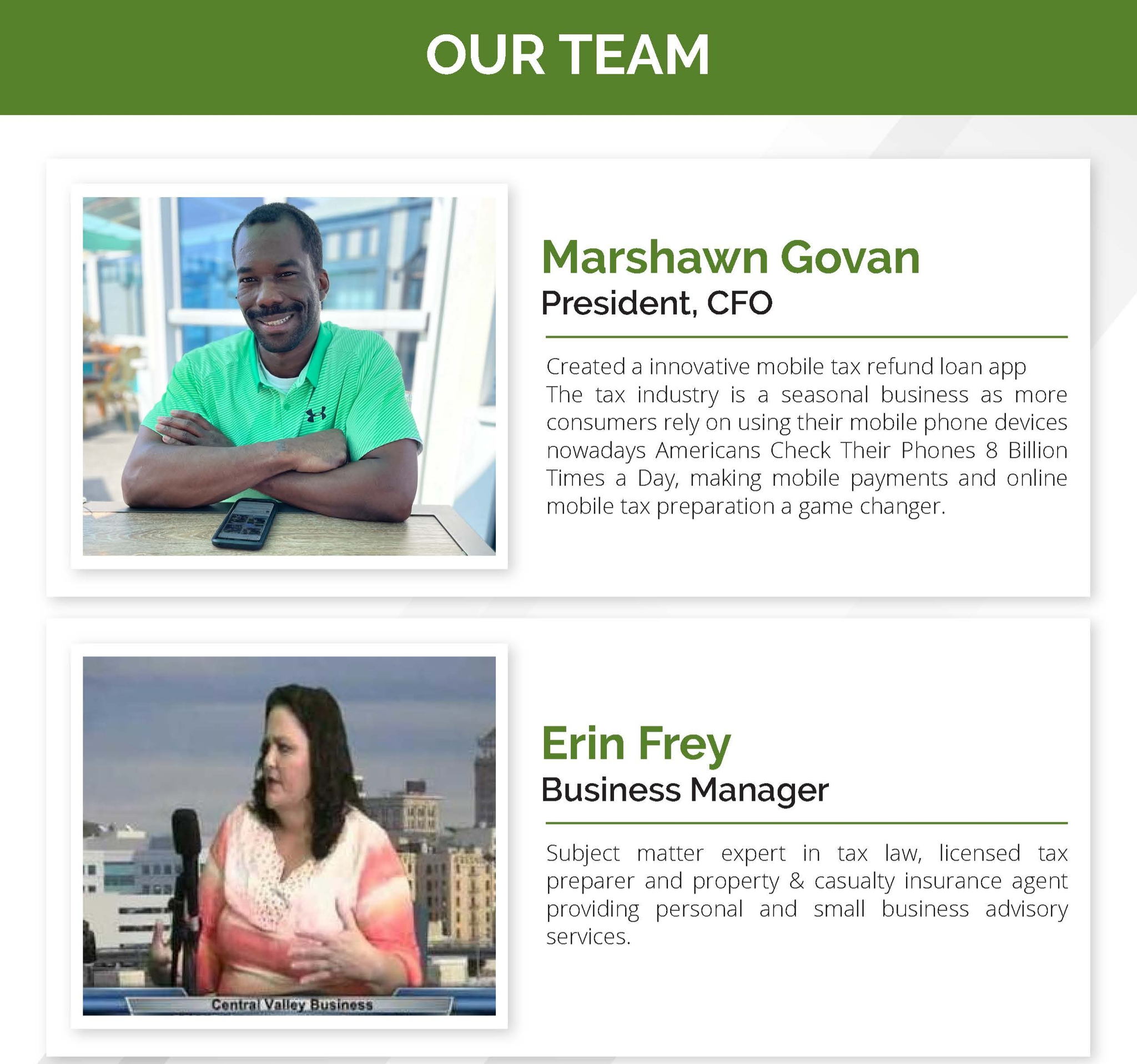

- If you need help, use online resources such as MKG Tax Consultants registered return tax preparer Tax Filing Mobile App instead of calling. Calling the IRS should be a last resort.

- Even if you are not normally required to file a tax return, you need to do so in order to claim a Recovery Rebate Credit, to receive a tax credit from 2021 stimulus payments, or to reconcile advance Child Tax Credit payments.

- File electronically and request direct deposit.

If you request an extension to file by April 18 (or 19), you have until Monday, October 17, 2022, to submit your 2021 tax return. You must pay your estimated taxes, however, by the regular tax filing deadline of April 18 (or 19)

Things That May Delay Your Refund

Even though you can file your tax return as soon as Jan. 24, 2022, by law the IRS cannot issue a refund involving the Earned Income Tax Credit (EITC) or Additional Child Tax Credit (ACTC) before mid-February. The purpose of the law is to prevent fraudulent refunds from being issued.

Download MKG Tax Consultants covid free Tax Filing Loan Originator Mobile App and Get Your Max Tax Refund