$1.00

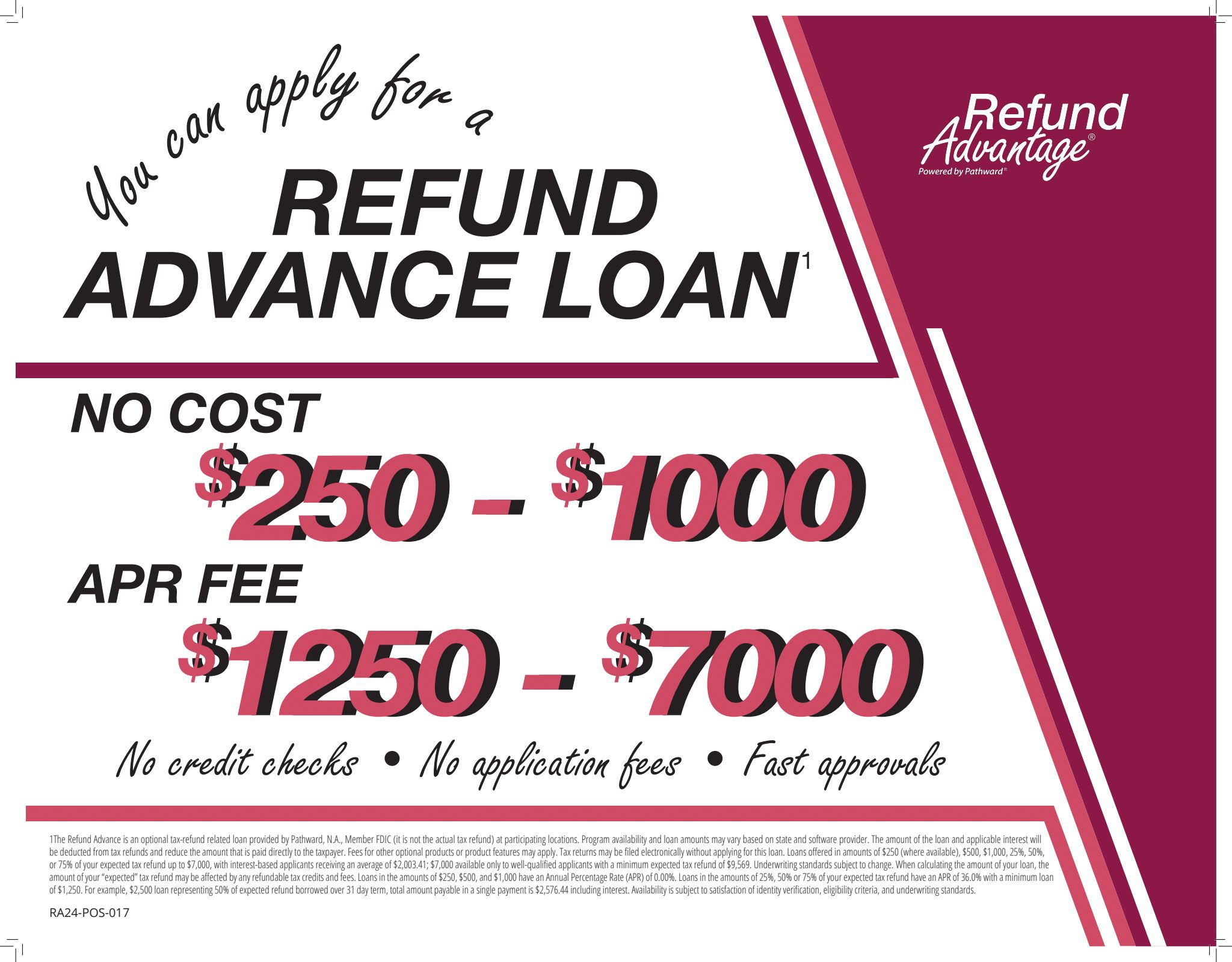

No Cost tax refund advances $250, $500, $1,000 interest free

Program availability and tax refund advance amounts may vary based on state and service provider. The amount of the tax advance and applicable interest will be deducted from tax refunds and reduce the amount that is paid directly to the taxpayer. Fees for other optional products or product features may apply. Securely upload tax documents to our secure Client Portal

No Cost tax refund advances $250, $500, $1,000 interest free

Applying for tax advance does not guarantee approval. Qualifications and restrictions apply and all applicants may not be eligible for a Tax Advance. Tax returns must be electronically filed with MKG Tax Consultants and be eligible for an electronic refund deposit.

Tax Advance offered in amounts of $250 (where available), $500, or $1,000, 25%, 50%, or 75% of your expected tax refund from $250 – $7,000.

For online/ remote tax filing, there is a $5.00 technology fee including mailing and preparer document fees, ensuring compliance and protecting transactions. This service verifies identity, prevents fraud, and safeguards access to tax refund-related products.

It’s time to get ready for tax season! To ensure we process your tax return smoothly, please complete your Client Data Sheet online.

📋 What You’ll Need to Update:

✅ Tax information

✅ Direct deposit details for faster refunds

How to Complete:

1️⃣ Visit our secure online client data sheet

2️⃣ Fill out the Client Data Sheet online.

3️⃣ Submit it instantly—no need to visit in person!

💬 Have questions? Contact us at 559-412-7248 for assistance.

Don’t delay—complete your form today to make this tax season quick and stress-free!

Tax Advance Loans $250- to $7,000 and Business Loans $500 to $10,000 For online remote/ tax filing, there is a $5.00 technology fee including mailing and preparer document fees, ensuring compliance and protecting transactions. This service verifies identity, prevents fraud, and safeguards access to tax refund-related products.

Monday - Friday : 10:00 AM – 8:00 PM PST

Saturday-Sunday 10am-5pm

MKG Enterprises Corp provides on-demand

online tax and financial services 24/7/365