$49.95

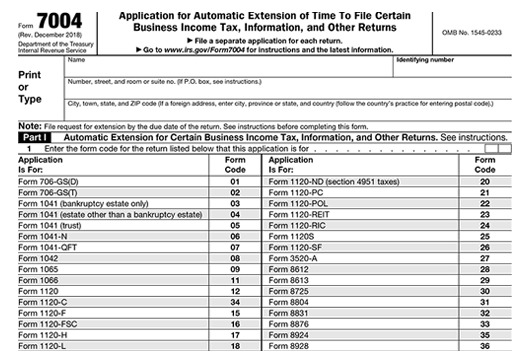

The Deadline to file business tax returns for partnerships, S corporations, or LLCs that are taxed as partnerships (Note that this is the deadline for calendar year filers. While most taxpayers fall under this category, there are special exceptions for fiscal-year taxpayers. If your tax year doesn’t start on Jan. 1, you will instead follow the IRS fiscal year due date

Skip the line, download our mobile app today, and get started with your tax return from the Safety of your home.

Largest possible tax refund or lowest tax liability “money-back written guarantee”

Professionally prepared by MKG Tax Consultants licensed tax preparers

Apple Store

https://apps.apple.com/us/app/mkg-tax-consultants/id1600628580

Google Play

https://play.google.com/store/apps/details?id=com.mkg.enterprises

Tax Advance Loans, Auto Title Loans, Business Loans $500 to $10,000

Monday - Friday : 10:00 AM – 8:00 PM PST

Saturday-Sunday 10am-5pm

MKG Enterprises Corp provides on-demand

online tax and financial services 24/7/365