$645.00

Prepare and file 1120-S Corporation US Tax Return. Before placing an order please contact us to ensure you have all the required documents to prepare and file your corporate taxes. We do basic accounting to prepare your return, however, the service does not include bookkeeping and audits, or financial compilation this is an additional fee and scope of work.

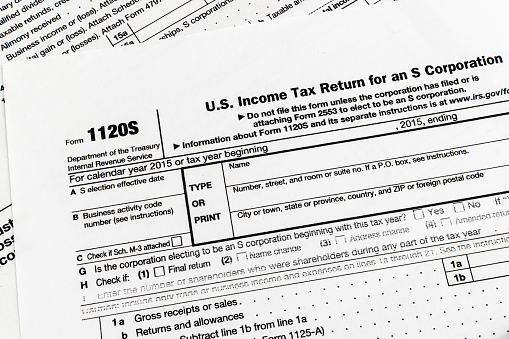

Prepare and file 1120-S Corporation US Tax Return

Business Owner Contact Info Submission Form

Before placing an order please contact us to ensure you have all the required documents to prepare and file your corporate taxes. We do basic accounting to prepare your return, however, the service does not include bookkeeping and audits, or financial compilation this is an additional fee and scope of work.

March 15, 2022:

Tax Advance Loans, Auto Title Loans, Business Loans $500 to $10,000

Monday - Friday : 10:00 AM – 8:00 PM PST

Saturday-Sunday 10am-5pm

MKG Enterprises Corp provides on-demand

online tax and financial services 24/7/365