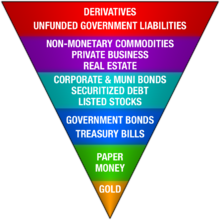

Exter is known for creating Exter’s Pyramid (also known as Exter’s Golden Pyramid and Exter’s Inverted Pyramid) for visualizing the organization of asset classes in terms of risk and size. In Exter’s scheme, gold forms the small base of most reliable value, and asset classes on progressively higher levels are more risky.

The larger size of asset classes at higher levels is representative of the higher total worldwide notional value of those assets. While Exter’s original pyramid placed Third World debt at the top, today derivatives hold this dubious honor.

Exter’s Golden Pyramid