In good times any financial analyst worth his salt would recommend 10% of his client’s portfolio be invested in gold and silver. But there is just one caveat these are not good times. Wouldn’t you agree? So 10% is a good place to start.

Hypothetical Scenario:

Wealth Income Strategy: MKG Tax Consultants client opens a Precious Metal IRA and buys or roll over a portion of their 401K, 403B, IRA, SEP etc. buys 1,000 oz of American Eagle Silver coins for cost bases of$15.07 per ounce shipped directly from the United States Mint valued at $55.95 per ounce either to their home or stored at The Delaware Trust Depository.

The purchase price is recorded at $15,070 and the gain is $40,880 we then reallocate the $53,597 American Eagle Silver Coins to Gold at $1,614.60 per ounce for 38oz of Gold

United States Mint American Eagle 2018

Gold, Silver, Platinum, Palladium Prices

https://finance.yahoo.com/commodities/ Total Capital Gains Tax You Will Pay $2,383

Tax Type Marginal Tax Rate Effective Tax Rate Tax Amount

Federal 15.00% 1.30% $519

State 8.00% 4.66% $1,864

Local 0.00% 0.00% $0

Total Capital Gains Taxes $2,383

Tax Advantage Income Strategy

Secure Your Retirement and Diversify Your Assets with a Self Directed IRA

Experts recommend placing about 10% of any portfolio in precious metals as a hedge against asset value erosion. Thanks to MKG Enterprises Business Trust “Asset Providers” relationships with leading custodians, you can easily add precious metals to your IRA portfolio too*

You can also roll your 401K over into a precious metal IRA. Your IRA custodian can advise you about this.

Why You Need a Self-Directed IRA

Why Self-Direct?

Asset diversification is especially critical for your retirement savings. It helps your portfolio to weather volatile markets and turbulent times. The trouble is that while all IRAs offer great tax advantages, most don’t allow you any control over what your money is placed in. So you cannot really balance your portfolio appropriately.

But there is an alternative. With a self-directed IRA, you get to choose the asset classes that you want to place your money in. The makeup of your portfolio is determined by your own investment decisions and choices instead of those of your employer or fund manager.

Why Precious Metals?

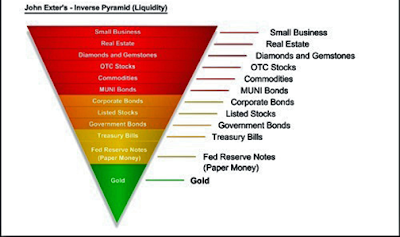

Because they tend to retain their value more than other assets, precious metals have traditionally acted as a buffer against instability. Market upheavals usually have a lower impact on precious metals than on other assets. Financial experts have always recommended placing about 10% of your funds in precious metals as a prudent strategy.

You can place precious metals in traditional and Roth IRAs and even in some 401K plans. You can transfer your existing IRA to a precious metal IRA without incurring taxes or penalties. At the end of its term, you can cash out your IRA or take possession of your precious metals to sell later. Placing precious metals in your IRA thus gives you flexibility in addition to a better-balanced portfolio.

Contact MKG Financial Group Equity Fund Advisors LLC Toll-Free 866-675-3766 to get started.

IRA-Eligible Precious Metal Products

For your IRA or 401K, you can choose from among the following:

Buy Gold

Buy Silver

Buy Platinum

Buy Palladium

IRA Real Estate Investing